Second Life “financial institutions” such as virtual banks and stock exchanges have historically been magnets for fraud and mismanagement.

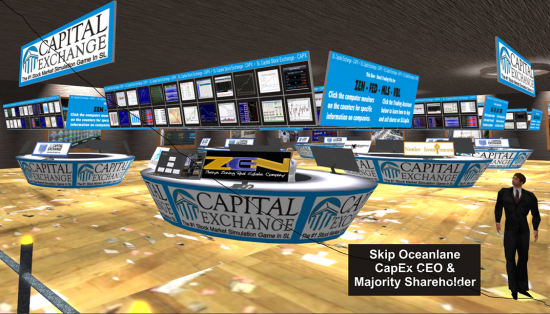

But the Capital Exchange — formerly the SL Capital Exchange, now under new management — promises to change that.

Carmen Dubaldi, who bought the exchange this January, has actual business experience under his belt. He is the owner of the Merle Norman Cosmetic Studio & Day Spa in New Windsor, NY, the assistant safety and loss control specialist at Orange County and a legislative coordinator at the New York State Assembly.

Dubaldi — who is known as Skip Oceanlane in Second Life — said that he got involved because of the corruption he saw happening with the exchanges in the past.

Just a game

According to Dubaldi, earlier stock exchanges made a mistake by not making it clear up front that they weren’t real exchanges.

CapEx is just a game, he said, a stock market simulation, not an actual investment vehicle.

“It’s a fun way to teach people how to trade stocks,” he said. “It’s the entertainment value.”

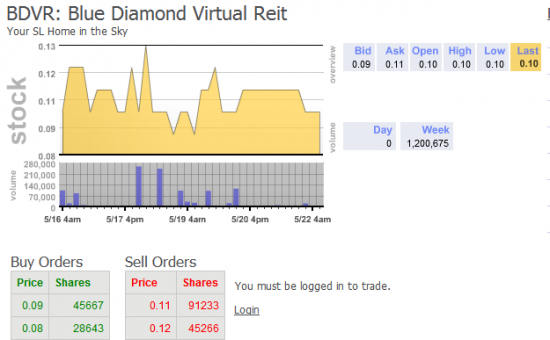

For example, the companies listed on the exchange are fictitious versions of virtual companies operating in Second Life.

If a virtual company has land inside Second Life, owns intellectual property, has cash reserves, owns a domain name, or has any other assets its CapEx shareholders don’t actually get a share of those underlying assets.

“All property listed is fictitious,” he said. “There might be people who actually think that they own a real part of the company. Those people are mistaken. They don’t.”

In fact, the property is owned by the individual behind the company, he said.

“But in the spirit of the game, the corporation owns it,” he said. “It’s like Monopoly. Do you really own Boardwalk and Park Place? No, you don’t really own Boardwalk and Park Place — you own Boardwalk and Park Place in the spirit of the game.”

The quarterly financial statements that CEOs submit to the exchange are fictitious as well — they may reflect what is happening in the virtual company they represent, or they might not — the CapEx has no ability to do audits.

Shareholders also have none of the rights they would have in a real stock exchange. For example, they can’t vote in a new CEO if the old CEO is running the company into the ground. They can try, but there’s no mechanism in place to force the old CEOs to give up their claims on the assets they own. There are no shareholder lawsuits. Embezzling CEOs don’t go to jail. Companies can’t be liquidated and sold off to repay investors.

In this, the CapEx is not significantly different from online stock market games like SmartStocks, the virtual exchange at HowTheMarketWorks.com, or the Stock Market Challenge game. Except that the stock market simulation games have users play with fictitious US dollars so the game doesn’t cost them any money, while CapEx has players use real Linden dollars.

So why would people invest in CapEx at all, instead of learning about the stock markets for free, with one of the other games?

One reason is that CapEx listed companies are allowed to pay dividends, in Linden dollars, to their investors.

“I don’t see a problem with people making a Linden profit off the trading,” he said, “As long as they adhere to the rules.”

In addition, investors might put in money to support the people behind these virtual companies. For example, CapEx itself is listed on its own exchange, as a virtual company.

“People are investing in Capital Exchange right now because they believe in what I’m doing,” Dubaldi said. “And that gives me a good feeling.”

His advice to would-be virtual stockholders is to only invest what they can afford to lose.

“People shouldn’t be putting in their retirement investments or money they need to pay their bills,” he said. “I tell everyone, start small, invest a couple of hundred Lindens at first, get to know how to trade, learn the system, learn the difference between a limit order and a market order, and work your way up.”

Playing fair

But just because it’s a game, it doesn’t mean that the participants don’t have to play fair.

“I have been a victim of many stock market scams myself,” he said. “I saw an opportunity at the end of 2010 to fulfill my dream of righting some of the wrongs of the past.”

And he now has proof, he added — now that he owns the CapEx software, he can look back through historical trading data — and see that money had been stolen from his personal trading account, two owners ago.

“They went in and stole US $750,000 in Lindens from people who had deposits at the bank, which was JP Financial at the time,” he said. “They gave people worthless stock, and the company that they were giving stock in has since ceased to exist. It was absolutely disgusting what they did.”

These kind of problems won’t happen at the CapEx, he said.

“We have put reforms into place where we put in a fair, safe platform where we have honesty, integrity,” he said. “I want to provide a fair platform for everyone to trade.”

He admits that enforcement is difficult, however.

“If someone brings to my attention that somebody is violating the rules, then I address it,” he said.

For example, if the CEO is embezzling money, then the company would be de-listed, he said.

And if the CEO has any money on account with the CapEx, or owns shares of other companies, there’s a possibility to pay the investors back.

“I did it myself three years ago, where there was a bank that failed — the CEO of the bank pretty much disappeared with a whole bunch of Lindens,” Dubaldi said. “I said, ‘This individual has defrauded the depositors, does this person have any shares?’ … Three of the four stock exchanges allowed me to sell their shares and take the proceeds and divide them among the depositors.”

At the end of the day, he was able to recover between 15 and 20 percent of the embezzled funds, he said. “Most people thought they lost everything, and I got them back 15 percent — that’s better than nothing.”

Dubaldi said that, as a result of his four-year experience with Second Life’s virtual stock exchanges, he can usually spot a scam when he sees it.

CapEx will also do a background check on the would-be CEO.

“We check how long an avatar has been around, did they ever list a company before, what assets they have within the game,” he said.

For example, if a company owner claims to have 500 regions inside Second Life, it’s easy enough to go out and check who the listed owner is on that land, he explained.

Service companies are a bit more difficult, as are start-ups.

“We frown on people coming to us with nothing but a dream,” he said.

CapEx will also ask for public comment about prospective public listings, he added.

“I don’t want someone listing on the exchange, getting a million Lindens, and disappearing,” he said. “That’s going to hurt the exchange. I want to try to stop that.”

However, despite precautions, companies are still going to fail, he added.

And, despite the rules, there will be unfair competition.

For example, company CEOs can trade their own stock with no restriction, Dubaldi said.

That means that a CEO has the chance to act on insider information — selling their stock right before a company goes under, for example.

However, there are controls in place to check the worst excesses.

“We have breakers in place that will prohibit a stock tumbling a serious amount,” he said. “And if I see some odd trading going on with the CEO, I would definitely say something to the CEO. I look at every single trade that goes through the system, I see everything.”

CEOs of virtual companies listed on the CapEx don’t have to disclose their real life identities, though some do so voluntarily.

Growth plans

“I saw an opportunity to take it over after things were kind of dead for a couple of years,” he said.

He declined to say exactly how much he paid for it, but that it was a combination of stock and cash. Virtual stock, that is.

“It was a significant amount of money, but it was a good deal,” he said.

What Dubaldi got for his investment was the brand name, the roster of existing customers — listed companies and stock investors — and the software to run the exchange.

He bought the exchange from previous owner Scott Bachrach (known as Scott Nestler in Second Life) who agreed to stay on for a couple of months to help Dubaldi learn the software.

Dubaldi currently has the Second Life virtual exchange market all to himself.

One potential competitor was the International Stock Exchange, where Dubaldi had been a minority “investor.” In late January, the two virtual companies announced a merger under which the ISE would transform into a currency exchange, and listed companies would move over to the CapEx.

As a result of the merger, and companies moving over from another defunct exchange, the CapEx grew from 10 listed companies when Dubaldi took it over to 30 today.

“I plan on adding two or three a month,” Dubaldi said. In addition, Dubaldi is working hard to increase the number of investors, which, today, stands at just over 14,000. “A lot of people haven’t caught up with the news yet, or have left Second Life, and we are trying to contact them and say they’ve got shares left.”

- International singers gather on Alternate Metaverse Grid for first annual International Day - April 15, 2024

- OpenSim hits new land, user highs - April 15, 2024

- Wolf Territories rolls out speech-to-text to help the hearing impaired - April 15, 2024