There’s been a lot of bad news about Bitcoin in the media recently — the problems at the Mt. Gox exchange, regulatory action in China and Russia, the Silk Road arrests and, more recently, a $2.7 million Silk Road hack.

This is on top of the more endemic problems of Bitcoin, which I’ve written about before.

But now a new Bitcoin issue has come to my attention, which I’ve somehow missed. And this issue basically is the death knell for the currency, even if all the other problems get fixed.

The problem is in Bitcoin’s most fundamental mechanism. The way the system works is that members of the Bitcoin community run computers that do mathematical calculations. In return for these calculations, they get Bitcoins, and the community gets processing power for keeping track of transactions.

“Right now, the two functions are wrapped up in each other,” said Peter Leeds, a financial expert and publisher of Penny Stocks.

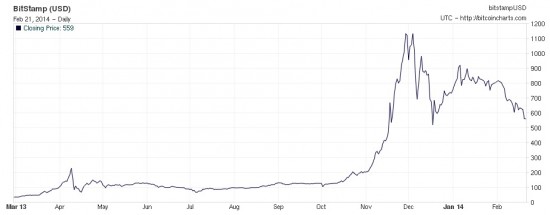

Over time, miners get fewer and fewer Bitcoins in return for the processing they are providing. Meanwhile, the number of transactions is going up — and the price of Bitcoins is falling.

“Early on, basic hardware could be used to mine Bitcoin profitably,” Leeds told Hypergrid Business.

Today, however, miners are using special-purpose ASIC cards and putting server farms in regions with extremely low costs of electricity. According to the Bitcoin mining profitability calculator, the result is about $2.50 a day in revenues for some with a $1,000 custom Bitcoin mining computer — and that’s before you subtract out the electricity costs and the labor costs of setting this up and managing it. If the price of Bitcoin falls to $100, the revenues drop to $0.80 a day.

“It becomes less worth it for people to become part of the system,” said Leeds.

One possibility is to separate out the mining function from the transaction processing. For example, exchanges or Bitcoin payment processing firms could step up and keep track of the transactions. But this would increase transaction costs and centralize the system.

“It’s going directly opposite to what the intention of Bitcoin was in the first place,” he said.

As a result, Leeds said, it’s now too risky to get into Bitcoin mining or investment.

“AÂ lot of people are getting involved in this wave late, and they will get burned if they get involved now,” he said. “In my opinion there’s only downside from here.”

Instead, he recommends that companies interested in doing business in Bitcoin use a third-party processor like BitPay or Coinbase to handle the transactions.

“Those types of businesses should do fine, because they’re not married to the survival of Bitcoin or the price of Bitcoin,” he said.

- Classic metaverse books on sale now at Amazon - May 16, 2024

- All OpenSim stats drop on grid outages - May 15, 2024

- 3rd Rock Grid residents find new homes on ZetaWorlds - May 14, 2024