With this week’s Daydream announcement, Google is cementing its strong early lead in the virtual reality platform race.

Although some virtual reality proponents don’t consider mobile-based headsets to be “real” virtual reality, this platform is adequate for watching traditional movies on virtual screens, and for experiencing virtual videos. This is currently the largest use case for virtual reality, and today’s smartphones are very good at videos.

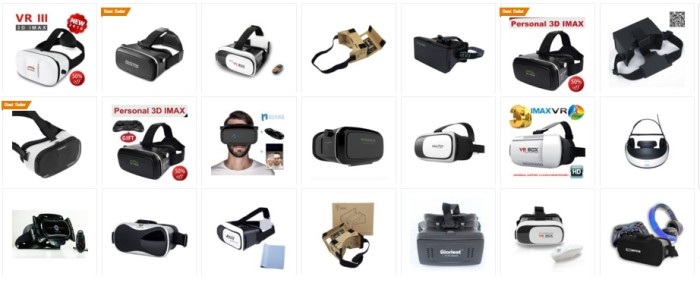

Mobile headsets are also significantly cheaper than both tethered and all-in-one headsets. (See 10 best VR headsets for under $100.)

The major alternatives to the Google ecosystem are Facebook, Oculus and Samsung on one hand and Sony’s PlayStation VR on the other. Steam partner HTC Vive, though an excellent set with great reviews, also has an extremely high price tag and is not compatible with any of the other platforms, meaning that it isn’t likely to be a top choice for either content creators or consumers.

Open platform

One big advantage of Google’s approach is that it is an open platform. Any company can make headsets and apps without having to get any approval or permission from anyone.

As a result, there are more than 100 manufacturers making compatible headsets, headsets that work with both Androids and iPhones. And there are already more than 1,000 virtual reality apps in the Google Play store.

There are also a bunch of makers of apps in other countries, typically distributed through local app stores. China is in the lead here, with several platforms competing to be the go-to destination for virtual reality reality. These don’t typically show up in the stats we get over here, but the overall numbers coming out of China are just jaw-dropping.

In addition, three of the largest Chinese phone manufacturers, Huawei, Xiaomi and ZTE, have signed up to be official Daydream partners.

The open platform also creates significant investment opportunities, since it offers many opportunities for both hardware and software startups.

Oculus, which is a proprietary platform with a tightly curated selection of applications, was originally expected to be at least somewhat compatible with other devices. However, on Friday Oculus released an update of its software that included “updates to platform integrity checks.” In other words, no more playing Oculus games on the Vive.

Big early lead in users

According to numbers released by SuperData late last month, 7.2 million non-Cardboard devices sales are expected to ship this year.

In the Facebook-Oculus-Samsung corner, Oculus is expected to ship 1.1 million devices and Samsung is expected to ship 3.5 million. Samsung is well on its way to meeting this target, having announced that they have sold 1 million headsets since last fall’s launch.

SuperData also predicts that Sony will ship 2.6 million PlayStation VRs, and HTC Vive is predicted to ship 1.1 million headsets — on a par with Oculus Rift shipments.

SuperData actually dropped its estimates recently because of production challenges, part shortages, and unexpected demand.

Meanwhile, let’s take a look at Google.

Hard numbers are hard to come by, but some estimates put the current total number of Cardboard-compatible headsets in the market at 30 million.

Can that be possible?

Well, to start with, Google itself has announced this week that it used by a million students. Seeding technology into schools is a favorite approach for technology platforms, since they hope to get in early in creating dedicated users.

And in January, Google announced that five million Google Cardboard headsets had shipped, but it seemed not to be counting Chinese shipments.

That could be because the Chinese manufacturers typically don’t comply with Google’s “Works with Cardboard” guidelines. In particular, Chinese headsets rarely if ever come with official QR Codes. They also typically have headstraps and adjustable lenses, both of which Google frowns on.

Plus, given that the primary market for Chinese manufacturers is Chinese users, getting the official Google stamp of approval could be seen a waste of time and effort.

How many headsets are being sold in China? One manufacturer, Baofeng Mojing, recently released some numbers a couple of months ago — in the first three months of this year, they sold one million headsets, and plan to sell 10 million by the end of 2016.

That’s one manufacturer out of over 100.

Baofeng Mojing also has an app store for virtual reality applications which, according to a report by YaoJieVR, has over 30 million users, including owners of devices made by other companies.

For another data point, last September, Chinese media reported that the two big ecommerce sites were selling 300,000 virtual reality headsets a month. With that as a base number, and adding in bricks-and-mortar distribution, it’s easy to see the numbers for China sales adding up rapidly.

And speaking of bricks-and-mortar distribution, Baofeng Mojing alone has 20,000 retail outlets selling its virtual reality headsets.

Quality and performance

Yes, Cardboard-compatible headsets don’t compare to the Vive. I’ve tried the Vive. Cardboard is no Vive.

Comparing a game for the Vive or the Oculus to a game for Cardboard is like comparing Call of Duty to Clash of Clans.

Is Call of Duty a better game? Obviously, by most measures, Call of Duty is better. But, sometimes, Clash of Clans is what you want — if you’re waiting in line at the store, for example, or on a train. Or if you don’t want to spend $40 on a game. Or only have a few minutes to play.

Would anyone argue that Clash of Clans or Angry Birds is not a “real” game? Maybe when smartphones first came out, and all the major video game studios ignored it because the user base was so small, and the games so low-quality, and the amount people were willing to pay for games was miniscule.

The same goes for virtual reality apps. If you compare Cardboard apps with Oculus or Vive apps head-to-head, you’ll be disappointed. But if you just enjoy the games for what they are — fun, casual, quick, low-cost experiences you can play anywhere — then mobile VR is not so bad.

Plus, as I mentioned above, the big killer app for virtual reality right now is media consumption, and mobile VR is just fine for that.

But wait. All of the above only applies to Cardboard devices. What about Daydream?

This platform, with the first devices and apps due out by the end of this year, promises significant technical advancements over Cardboard.

The official specs aren’t released yet, but Google promises that Daydream headsets will have low persistence displays, no ghosting, low latency, high quality processors for high frame rates and high quality sensors.

Plus, the hardware is paired with a new virtual environment similar to Gear VR’s, where users can choose virtual reality applications, a new VR-only app store, and new specifications for the applications themselves so they can take advantage of the new hardware.

That puts Daydream on a competitive basis with Gear VR.

Combine that with the fact that people replace their smartphones every one or two years — while they replace their desktops or consoles every five years — you can see that the performance on the mobile side will increase rapidly due to the upgrade cycle alone.

Then you’ve got to add in the competitive environment. Baofeng Mojing, for example, has already released five versions of its virtual reality headset. They started with a simple cardboard box, and their latest release approaches the Gear VR in looks and usability, or, at least, as far as they can currently get with the current smartphone hardware.

Their competitors are already pushing the boundaries even further. The BoboVR Z4, for example, promises a 120 degree field of view, compared to the Gear VR’s 96 degrees. And the Pico1 headset has an integrated touchpad, similar to that of the Gear VR.

With three Chinese smartphone manufacturers already on board for the Daydream platform, and others expected to follow quickly, the headset and application manufacturers are also likely to embrace the new technology as soon as they can.

For us, the consumers, it means even lower prices, better quality, and more choices.

- Classic metaverse books on sale now at Amazon - May 16, 2024

- All OpenSim stats drop on grid outages - May 15, 2024

- 3rd Rock Grid residents find new homes on ZetaWorlds - May 14, 2024